E-commerce Agriculture

E-commerce in agriculture refers to the utilization of online platforms and digital technologies to facilitate the buying and selling of agricultural products and services. This concept aims to create direct farmer-buyer links with less or no brokerage, which helps farmers invest in ways that increase yield. E-commerce provides agricultural businesses with access to a global market, allowing them to reach new customers and expand their reach beyond traditional geographic boundaries. It also provides consumers with access to a wider range of products and allows them to purchase products from the comfort of their own homes. To succeed, agri e-commerce businesses require scalable and sustainable business models that reflect local market conditions.

Selling produce through online channels enables farmers to bypass intermediaries, leading to improved income for the farmers, reduced wastage and fresher produce for customers. These benefits are particularly important in developing economies, where more than 97% of people employed in agriculture live and where the sector’s contribution to GDP is in double digits.

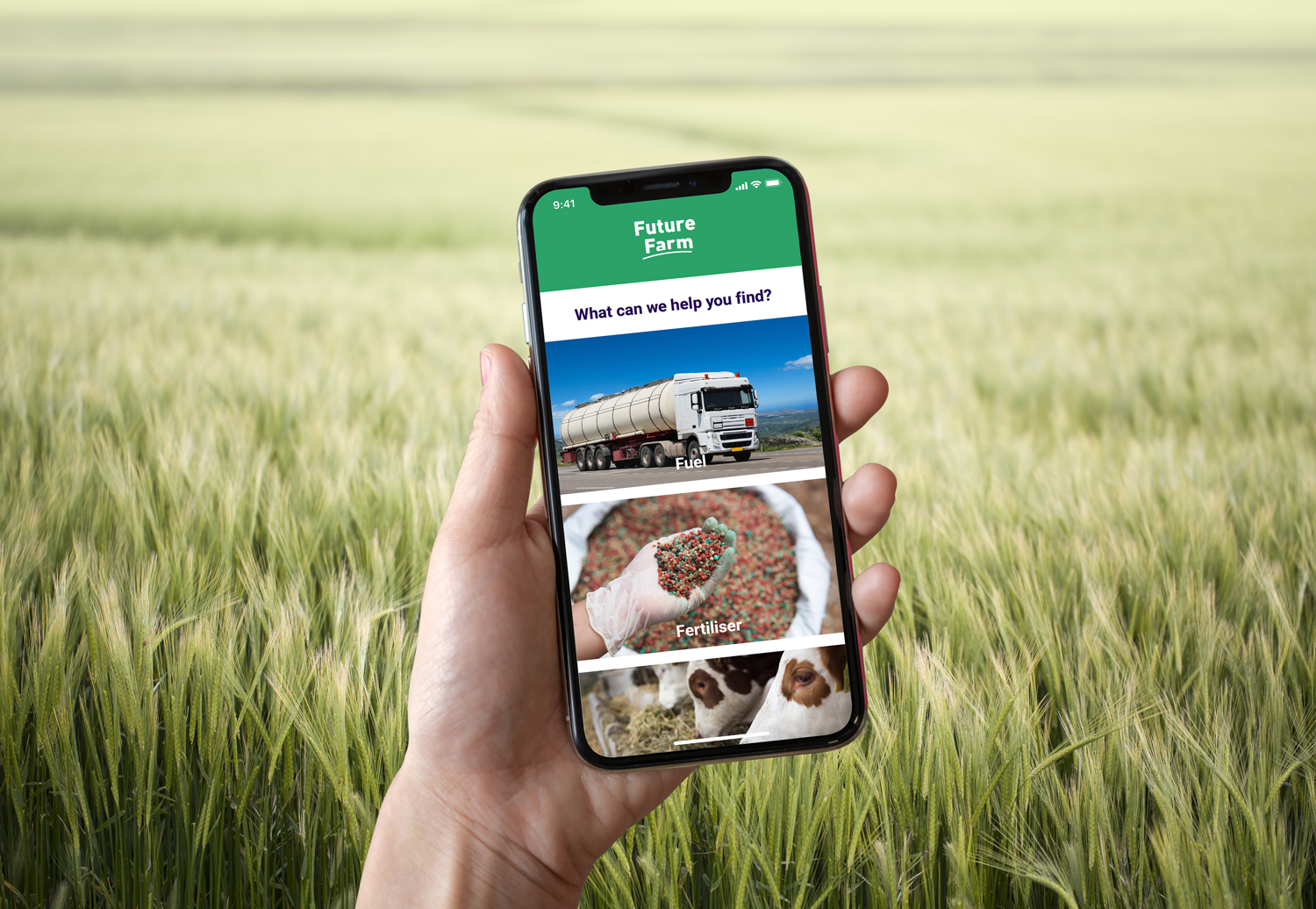

Mobile operators have been central to the adoption of mobile-enabled solutions in the agricultural sector and can continue this role in agri e-commerce. In addition to providing extensive rural connectivity and facilitating digital payments through mobile money, mobile operators can leverage other strengths to drive the scale and sustainability of agri e-commerce services. This is possible through launching operator-led products, as well as working in partnership with an existing agri e-commerce business.

To succeed, agri e-commerce businesses require scalable and sustainable business models that reflect local market conditions. This report from the GSMA analyses the factors that agri e-commerce businesses must consider when developing their business model, focussing on Sub-Saharan Africa as well as developing countries in Asia and Latin America. The report contains key emerging trends, case studies and recommendations for stakeholders to maximise the agri e-commerce opportunity. It also includes GSMA’s Market Attractiveness Index, which examines several enablers to understand the agri-ecommerce readiness of developing countries.

Selling produce through online channels enables farmers to bypass intermediaries, leading to improved income for the farmers, reduced wastage and fresher produce for customers. These benefits are particularly important in developing economies, where more than 97% of people employed in agriculture live and where the sector’s contribution to GDP is in double digits.

Mobile operators have been central to the adoption of mobile-enabled solutions in the agricultural sector and can continue this role in agri e-commerce. In addition to providing extensive rural connectivity and facilitating digital payments through mobile money, mobile operators can leverage other strengths to drive the scale and sustainability of agri e-commerce services. This is possible through launching operator-led products, as well as working in partnership with an existing agri e-commerce business.

To succeed, agri e-commerce businesses require scalable and sustainable business models that reflect local market conditions. This report from the GSMA analyses the factors that agri e-commerce businesses must consider when developing their business model, focussing on Sub-Saharan Africa as well as developing countries in Asia and Latin America. The report contains key emerging trends, case studies and recommendations for stakeholders to maximise the agri e-commerce opportunity. It also includes GSMA’s Market Attractiveness Index, which examines several enablers to understand the agri-ecommerce readiness of developing countries. Benefits

Increase of revenues

With online platforms, farmers can tell the local communities about themselves and get many new earning opportunities. Moreover, selling products directly to consumers also helps to get higher profits.

Better financial inclusion

Increase of revenues

With online platforms, farmers can tell the local communities about themselves and get many new earning opportunities. Moreover, selling products directly to consumers also helps to get higher profits.

Better financial inclusion

In the traditional system, farmers practically do not participate in the financial industry. Many cash transactions with intermediaries are informal and are conducted even without a receipt. As a result, farmers do not even have any official records of their sales.

With software solutions, they can openly make official transactions and keep their records and build their financial history. And they will be able to demonstrate their creditworthiness to financial and banking institutions for getting access to loans, investing, and other funding options.

In the traditional system, farmers practically do not participate in the financial industry. Many cash transactions with intermediaries are informal and are conducted even without a receipt. As a result, farmers do not even have any official records of their sales.

With software solutions, they can openly make official transactions and keep their records and build their financial history. And they will be able to demonstrate their creditworthiness to financial and banking institutions for getting access to loans, investing, and other funding options.

Reduction of wastage

eCommerce platforms make it possible to reduce the time needed for products to reach end consumers. For example, going online, farmers can sell fresher vegetables and fruits and minimize the risks of post-harvest wastage.

Enhanced productivity

Reduction of wastage

eCommerce platforms make it possible to reduce the time needed for products to reach end consumers. For example, going online, farmers can sell fresher vegetables and fruits and minimize the risks of post-harvest wastage.

Enhanced productivity

In combination with consumers’ interest in tracing the origin of the food they buy, all three points mentioned above can become great incentives for farmers. As a result, they are more motivated to expand their activities, improve the quality of their products and increase investments in agricultural machinery and planting methods.

Better external investing

Agri e-commerce services positively influence the development of related services in the region, like logistics and mobile finance. In their turn, these related services can promote the financial and digital inclusion of many gamers, even the poorer ones, and increase the investment attractiveness of the sector.

In combination with consumers’ interest in tracing the origin of the food they buy, all three points mentioned above can become great incentives for farmers. As a result, they are more motivated to expand their activities, improve the quality of their products and increase investments in agricultural machinery and planting methods.

Better external investing

Agri e-commerce services positively influence the development of related services in the region, like logistics and mobile finance. In their turn, these related services can promote the financial and digital inclusion of many gamers, even the poorer ones, and increase the investment attractiveness of the sector.

Boosters

Even in the developing regions, today, we can observe several tendencies that show us that the integration of Agri eCommerce services is possible.

- Mobile internet penetration is growing. It leads to an increasing number of people who can use eCommerce solutions.

- Logistics networks are expanding. Now even those farmers who are based in the most remote areas can get the possibility to deliver their produce to urban areas.

- The popularity of online payments is growing. Earlier farmers work only via cash transactions, and now digital payment methods can be applied, which is a good option when you want to sell or buy something online.

- General urbanization is still gaining momentum. Some decades ago, much more people lived in rural areas where they all could plant their vegetables and crops. Now, with more people living in towns and cities, the demand for farming produce is rising.

- People want to know more about the products that they buy. Today, as there is a lot of information about the importance of healthy food and natural products, people’s awareness is growing. In addition, consumers want to see when, where and by whom goods are produced. eCommerce platforms can provide the necessary transparency.

- Today more people start using eCommerce services. Even without mentioning agribusiness and farming, we can see that people actively use online marketplaces. And it is one more good tendency that can support the development of eCommerce platforms in agriculture.

Challenges

Some pitfalls can be viewed as barriers to the E-commerce revolution in agriculture. Is it possible to overcome these barriers below ? Definitely yes. But, of course, that’s the question of time and efforts from the side of all market players.

Some pitfalls can be viewed as barriers to the E-commerce revolution in agriculture. Is it possible to overcome these barriers below ? Definitely yes. But, of course, that’s the question of time and efforts from the side of all market players.

-

- Many consumers prefer to buy fruits and vegetables in traditional offline stores as they want to see with their own eyes what they are buying.

- Many farmers who live in poorer districts do not have access to stable internet and mobile devices.

- Issues with logistics and warehousing still exist in many regions.

- Intermediaries control Agri supply chains, and it is not easy to immediately exclude them from all the processes.

E-commerce in Agriculture

Applications

Agrimp

A B2B digital marketplace that brings together farmers and industrial buyers. They offer a user-friendly platform that generates market opportunities for farmers and industry buyers. They provide unlimited access to a global market from anywhere, at any time. They also offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services.

Farmsquare

An online agricultural store and marketplace for farmers. They help you discover the local farmers’ market near you for fresh produce and agricultural inputs. They also help you find the best markets for farm inputs and more.

Agrimp

A B2B digital marketplace that brings together farmers and industrial buyers. They offer a user-friendly platform that generates market opportunities for farmers and industry buyers. They provide unlimited access to a global market from anywhere, at any time. They also offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services.

Farmsquare

An online agricultural store and marketplace for farmers. They help you discover the local farmers’ market near you for fresh produce and agricultural inputs. They also help you find the best markets for farm inputs and more.

AgriBros Market

A digital platform specialized in the promotion and marketing of agricultural products, connecting farms to markets and promoting local products internationally. Web, mobile and SMS platform (USSD) connecting local farmers and producers to potential buyers and end consumers on a digital market and allowing crowdfunding of projects in the agricultural and agri-food sector.

Agro

An online agricultural market that caters to farm equipment, vehicles, tools, machinery, fields, etc. They offer weekly products where the buyer can have commodities at reduced prices. Other than weekly offers, Agrofy has a section of top offers and an impeccable featured searches option.

AgriBros Market

A digital platform specialized in the promotion and marketing of agricultural products, connecting farms to markets and promoting local products internationally. Web, mobile and SMS platform (USSD) connecting local farmers and producers to potential buyers and end consumers on a digital market and allowing crowdfunding of projects in the agricultural and agri-food sector.

Agro

An online agricultural market that caters to farm equipment, vehicles, tools, machinery, fields, etc. They offer weekly products where the buyer can have commodities at reduced prices. Other than weekly offers, Agrofy has a section of top offers and an impeccable featured searches option.

eWorldTrade

A B2B platform that offers a wide range of agricultural commodities. They provide a user-friendly platform that generates market opportunities for farmers and industry buyers. They offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services. eWorldTrade has various membership packages to cater to clients’ needs.

Amazon Business

An online marketplace that caters to B2B transactions. They provide an array of products where there are finest agricultural products too. It is a virtual world where there are authentic Wholesale Agricultural Products Amazon targets several industries and has a perfect solution for every market. They service their clients by integrating multiple payment methods. The website shows each detail regarding the products for a better understanding.

eWorldTrade

A B2B platform that offers a wide range of agricultural commodities. They provide a user-friendly platform that generates market opportunities for farmers and industry buyers. They offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services. eWorldTrade has various membership packages to cater to clients’ needs.

Amazon Business

An online marketplace that caters to B2B transactions. They provide an array of products where there are finest agricultural products too. It is a virtual world where there are authentic Wholesale Agricultural Products Amazon targets several industries and has a perfect solution for every market. They service their clients by integrating multiple payment methods. The website shows each detail regarding the products for a better understanding.

B2BAgriculture

A B2B marketplace that connects farmers and industrial buyers. They offer a user-friendly platform that generates market opportunities for farmers and industry buyers. They provide unlimited access to a global market from anywhere, at any time. They also offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services.

Agro InfoMart

An online agricultural market that caters to farm equipment, vehicles, tools, machinery, fields, etc. They offer weekly products where the buyer can have commodities at reduced prices. Other than weekly offers, Agrofy has a section of top offers and an impeccable featured searches option.

B2BAgriculture

A B2B marketplace that connects farmers and industrial buyers. They offer a user-friendly platform that generates market opportunities for farmers and industry buyers. They provide unlimited access to a global market from anywhere, at any time. They also offer transparent and reliable market information, deal creation, and negotiation. They accommodate online payments between buyer and seller, product quality check options, and end-to-end logistic services.

Agro InfoMart

An online agricultural market that caters to farm equipment, vehicles, tools, machinery, fields, etc. They offer weekly products where the buyer can have commodities at reduced prices. Other than weekly offers, Agrofy has a section of top offers and an impeccable featured searches option.

Agree Market

A web-based platform that facilitates the process of agricultural commodity transactions with a B2B scheme between off-takers and MSMEs, HORECA (Hotel, Restaurant & Cafe), Enterprises, Start-Ups, and Supermarkets (both traditional and modern markets). The products traded are agricultural products, protein, and cooking ingredients.

Indonesia Agritech Market Outlook

The Indonesian Agritech market has experienced impressive growth in the last five years with a CAGR of ~39.7% based on revenue generated, due to increased internet access among Indonesian farmers.

Statista

Statista provides data and facts about the agricultural industry in Indonesia. Indonesia is one of the world’s largest producers and exporters of agricultural products, providing important commodities such as palm oil, natural rubber, cocoa, coffee, rice, and spices to the world. The agricultural industry is also the largest employment sector in the country. However, the share of Indonesia’s GDP from the agricultural sector has declined as the country shifts towards industrialization.

Agree Market

A web-based platform that facilitates the process of agricultural commodity transactions with a B2B scheme between off-takers and MSMEs, HORECA (Hotel, Restaurant & Cafe), Enterprises, Start-Ups, and Supermarkets (both traditional and modern markets). The products traded are agricultural products, protein, and cooking ingredients.

Indonesia Agritech Market Outlook

The Indonesian Agritech market has experienced impressive growth in the last five years with a CAGR of ~39.7% based on revenue generated, due to increased internet access among Indonesian farmers.

Statista

Statista provides data and facts about the agricultural industry in Indonesia. Indonesia is one of the world’s largest producers and exporters of agricultural products, providing important commodities such as palm oil, natural rubber, cocoa, coffee, rice, and spices to the world. The agricultural industry is also the largest employment sector in the country. However, the share of Indonesia’s GDP from the agricultural sector has declined as the country shifts towards industrialization.

Next wave of evolution in agribusiness marketplaces

B2B user expectations are moulded to those of B2C

There is a great upside to being one of the slower market sectors to embark on B2B marketplaces. At least 80% of B2B buyers are not only looking for but expect a buying experience like that of a B2C customer.

Given many B2B buyers are interacting with B2C marketplaces in their day-to-day private lives, we will expect the B2B customer demand for user experience to grow more similar to those of B2C with every day passing.

Omnichannel communication and a personalization experience to deliver a convenience and seamless purchasing process seem will gradually become an essential differentiator to acquire new customers and drive customer retention and loyalty.

There is a great upside to being one of the slower market sectors to embark on B2B marketplaces. At least 80% of B2B buyers are not only looking for but expect a buying experience like that of a B2C customer.

Given many B2B buyers are interacting with B2C marketplaces in their day-to-day private lives, we will expect the B2B customer demand for user experience to grow more similar to those of B2C with every day passing.

Omnichannel communication and a personalization experience to deliver a convenience and seamless purchasing process seem will gradually become an essential differentiator to acquire new customers and drive customer retention and loyalty. Increasing adoption of blockchain agriculture

Blockchain agriculture is predicted to grow in importance as food quality is fast becoming an issue of concern globally. Imagine the journey our food takes after it leaves the farm as it passes through numerous hands and processes before getting onto the dinner table. Through blockchain technology, we will be able to attain both provenance and traceability from food source to destination via one single source of the truth. This empowers all buyers to have greater supply chain transparency and increase consumer trust in the food purchased.

Foodshed and Agrimp are two examples of blockchain enabled agribusiness platforms. Foodshed uses blockchain technology to create transparency supply chain, reduce supply chain inefficiencies by connecting local sustainable and independent producers to local wholesale markets, restaurants and grocery stores on via its mobile marketing and logistics app.

Blockchain agriculture is predicted to grow in importance as food quality is fast becoming an issue of concern globally. Imagine the journey our food takes after it leaves the farm as it passes through numerous hands and processes before getting onto the dinner table. Through blockchain technology, we will be able to attain both provenance and traceability from food source to destination via one single source of the truth. This empowers all buyers to have greater supply chain transparency and increase consumer trust in the food purchased.

Foodshed and Agrimp are two examples of blockchain enabled agribusiness platforms. Foodshed uses blockchain technology to create transparency supply chain, reduce supply chain inefficiencies by connecting local sustainable and independent producers to local wholesale markets, restaurants and grocery stores on via its mobile marketing and logistics app.

Agrimp is a B2B cloud-based digital marketplace for transactions of food crops with complementary services including logistics, quality inspections, secure payments, and legal support. Agrimp has introduced blockchain technology to improve food traceability and sustainability, and insurance coverage for all the major risks known in the agri-business.

Despite blockchain’s apparent benefits, it will take some time for the blockchain technology to be truly affordable and scalable, especially for adoption in the developing countries where agribusiness is significant to the overall economy.

Agrimp is a B2B cloud-based digital marketplace for transactions of food crops with complementary services including logistics, quality inspections, secure payments, and legal support. Agrimp has introduced blockchain technology to improve food traceability and sustainability, and insurance coverage for all the major risks known in the agri-business.

Despite blockchain’s apparent benefits, it will take some time for the blockchain technology to be truly affordable and scalable, especially for adoption in the developing countries where agribusiness is significant to the overall economy. Expansion of complementary ecosystem products and services

Today, most agribusiness marketplaces started off being relatively specialized in their value proposition to address specific pain points within the food chain. As they scale, they can’t rely on being a niche player. Ecosystem partnerships become a critical competitive advantage with partners providing augmentative products and services to the different users within the agribusiness marketplace.

The large captive user base of a successful marketplace offers massive opportunities for monetization with limited marketing investments. Examples of such complementary services could be marketing services, microfinancing, farmer insurance and financing, food quality assurance and validation services, warehousing and logistics services or equipment warranty and maintenance services.

Yagro is the closest illustration of an agribusiness marketplace ecosystem that was identified. With Yagro Marketplace being the key foundation platform, complementary services such as Yagro Insurance, Price Check, Programme Check and Strategic Agronomy are added as part of an integrated offering to the farmers.

Today, most agribusiness marketplaces started off being relatively specialized in their value proposition to address specific pain points within the food chain. As they scale, they can’t rely on being a niche player. Ecosystem partnerships become a critical competitive advantage with partners providing augmentative products and services to the different users within the agribusiness marketplace.

The large captive user base of a successful marketplace offers massive opportunities for monetization with limited marketing investments. Examples of such complementary services could be marketing services, microfinancing, farmer insurance and financing, food quality assurance and validation services, warehousing and logistics services or equipment warranty and maintenance services.

Yagro is the closest illustration of an agribusiness marketplace ecosystem that was identified. With Yagro Marketplace being the key foundation platform, complementary services such as Yagro Insurance, Price Check, Programme Check and Strategic Agronomy are added as part of an integrated offering to the farmers.

Investments in online marketplaces with future consolidation

The development of agribusiness marketplaces is still in its infancy stage compared to other industry sectors (e.g., retail, consumer goods and industrial) which has been affected and reshaped by marketplace technology advancements. We will see a greater number of new startups being founded and investment funding poured into promising startups as they address technology and supply chain inefficiencies along the food chain.

Future acquisitions are also likely to occur as larger-sized traditional agriculture organisations take an increased interest in these online agribusiness marketplaces and leverage acquisitions to gain faster market entry vs. building their own in-house digital platforms. However, we do not foresee such consolidation efforts in the immediate two years as the general conservative nature of these businesses will more likely trigger a monitoring behaviour to identify the optimal acquisition candidates for the right time, right place purchase further into the future.

The development of agribusiness marketplaces is still in its infancy stage compared to other industry sectors (e.g., retail, consumer goods and industrial) which has been affected and reshaped by marketplace technology advancements. We will see a greater number of new startups being founded and investment funding poured into promising startups as they address technology and supply chain inefficiencies along the food chain.

Future acquisitions are also likely to occur as larger-sized traditional agriculture organisations take an increased interest in these online agribusiness marketplaces and leverage acquisitions to gain faster market entry vs. building their own in-house digital platforms. However, we do not foresee such consolidation efforts in the immediate two years as the general conservative nature of these businesses will more likely trigger a monitoring behaviour to identify the optimal acquisition candidates for the right time, right place purchase further into the future.